Offshore drilling: “systemic” safety problems?

How safe are Ghana’s offshore oil drilling operations? According to officials I’ve interviewed here so far, Ghana’s oil operations are safe, secure and pose no particular threats to people or the environment. An EPA official in Takoradi assured me that the waters off the coast of Ghana are much calmer than those in the Gulf of Mexico. He also reminded me that the Deepwater Horizon spill was due to human error and that Ghana is constantly verifying every aspect of the oil operations in order to avoid any mistakes. Spin. Of course. After all, what are officials going to tell me? That they’re worried? Continue reading . . .

Abuesi

Imagine a place where fishing is the only game in town. Then imagine just how nervous the residents must be about offshore oil drilling.

The place is Abuesi, a small town at the water’s edge about 30 minutes down the road from Takoradi.

Fish and oil

Fish and oil: What’s at stake?

Here in Ghana, oil is expected to account for about 5% of the GNP when production gets up to speed. The fishing industry also contributes nearly 5% to the GNP. The number of jobs for Ghanaians that the oil industry may create is still unknown, but there’s no mystery about fishing. Approximately one-fifth of Ghana’s population depends on fishing. That’s huge, but in the Western Region fishing communities have to accommodate the oil industry. The oil industry meanwhile doesn’t have to do anything for the fishermen. Continue reading . . .

Ghana dreaming…

“Ghana dreaming. That’s what you should call your story.” On a packed flight to Accra, I ended up by chance seated next to an American oil and gas professional who has been living in Ghana and working throughout the Gulf of Guinea for the past 15 years. We started chatting and I told him I was going to Ghana to report on the country’s new oil industry.

“Ghana dreaming. That’s what you should call your story.” On a packed flight to Accra, I ended up by chance seated next to an American oil and gas professional who has been living in Ghana and working throughout the Gulf of Guinea for the past 15 years. We started chatting and I told him I was going to Ghana to report on the country’s new oil industry.

He wasn’t at all excited about Ghana’s entry into the petroleum club. This man looks at the oil industry in terms of job prospects and for him Ghana’s Jubilee field is a bust.

As he explained to me, deepwater drilling is a highly specialized operation; the equipment and materials arrive from outside the country, are installed by specialized expat crews and then provide virtually no business for local maintenance companies or jobs for oil workers.

For this freelance operator the idea that Ghana’s oil industry is going to create a business boom is no more than a pipe dream. Continue reading . . .

African Democracy and Oil: A Combustible Mix

Oil and democracy: do they mix?

A few days ago in his FiveThirtyEight blog, Nate Silver considered Egypt, Oil and Democracy:

There is a large body of literature in political science connecting oil wealth and democratization. Although the conclusions are not universally accepted and there are some exceptions — Norway, for instance, is one of the most petroleum-rich countries in the world, and also one of the most democratic — the consensus view is toward what Thomas L. Friedman refers to as The First Law of Petropolitics: oil and democracy do not mix.

He then pointed to data from 21 Middle Eastern and North African countries, which showed an inverse relationship between democracy and resource wealth. In other words, the more oil a country has, the less likely it is to be democratic. Continue reading . . .

Key political risks in the Gulf of Guinea

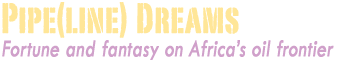

Ghanaian President John Atta Mills (second right) turns the valve to flag off first oil production at FPSO Kwame Nkrumah oil rig at the Jubilee field in Takoradi after flagging off production of oil on December 15, 2010. The country has raised its pump prices. AFP | AFRICA REVIEW |

Business news from Reuters. The Gulf of Guinea tempts investors, but the terrain is not without risk. I love business news — everything boils down to dollars and cents and risks are just part of doing business. Go somewhere else to find out why the area is so volatile. Maybe has something to do with all those profits that never seem to benefit local communities.

I’m reprinting this article nonetheless, because it is a snapshot of the region and what to watch for in the coming months. One note: The article mentions Ivory Coast and “political uncertainty”, but does not bring up the regional political calendar. This is an election year across much of the Gulf of Guinea and events in the Ivory Coast, Tunisia and Egypt may very well have repercussions on regional politics. (Consider Gabon, where demonstrators have been brandishing signs calling for President Ali Bongo to leave.)

Feb 1 (Reuters) – A stretch of West Africa’s coast spanning more than a dozen countries, the Gulf of Guinea is a growing source of oil, cocoa and metals to world markets.

But rising rates of piracy, drug smuggling, and political uncertainty in an area ravaged by civil wars and coups have made it a challenging destination for investors seeking to benefit from the massive resources.

The Gulf of Guinea runs from Guinea on Africa’s northwestern tip to Gabon in the south and includes Nigeria, Ghana, Ivory Coast, Democratic Republic of Congo, and Cameroon.

NEW ENERGY FRONTIER?

Gulf of Guinea nations produce more than 3 million barrels of oil per day — about 4 percent of the global total — mostly for European and American markets, with the bulk coming from OPEC-member Nigeria (2.2 million bpd).

Smaller producers include Equatorial Guinea (300,000 bpd), Congo Republic (340,000 bpd), Gabon (230,000 bpd), Cameroon (66,000 bpd) and Ivory Coast (40,000 bpd).

While many of the region’s producers are struggling to maintain output, oil companies believe the deep seas along the coast west of Nigeria could be a new frontier.

Ghana joined the ranks of West African oil producers in December and is expected to ramp up output to 150,000 bpd in the coming months. Further out, Sierra Leone and Liberia hope offshore drilling will spell oil riches for them as well.

Washington estimates the Gulf of Guinea will supply about a quarter of U.S. oil by 2015 and has sent military trainers to the region to help local navies secure shipping.

What to watch:

President of Equatorial Guinea new chairman of African Union

News flash: Teodoro Obiang Nguema Mbasogo is the new chairman of the African Union.

News flash: Teodoro Obiang Nguema Mbasogo is the new chairman of the African Union.

I’m reprinting a brief article from the Pan African news agency, PANAPRESS. Referring to Tunisia and Egypt, the article’s author asserts that this unfortunate choice ignores the “deep aspirations” of the African peoples for liberty and human rights. Indeed.

Human rights body faults choice of Nguema as AU chairman

Addis Ababa, Ethiopia (PANA) – An African rights body Sunday expressed indignation after Equatorial Guinea President Theodoro Obiang Nguema Mbasogo assumed the Chairmanship of the African Union (AU) at the 16th ordinary summit of the continental organisation.

The African Rally of the Defence of Human Rights, known by its acronym as RADDHO, claimed that the choice of Nguema Mbasogo “will seriously damage the image of the African continent and the debate planned by the AU on democratic values will lack credibility.”

Known internationally as a dictator, RADDHO said, UNESCO was obliged to reject the prize offered by Nguema to that organisation, mainly because of “the catastrophic human rights record of Equatorial Guinea”.

According to the rights body, Equatorial Guinea is notorious for its systematic torture of political opponents and violation of human rights, with the opposition completely muzzled. Also, it neither has independent media nor space for civil society organisations.

Will the Chinese use the Chad-Cameroon pipeline?

I just stumbled across an interesting bit of news. China and ExxonMobil may do business together in Chad. I said, “may,” not “will,” but this could be a significant development.

It is fascinating the way information about the Chad-Cameroon pipeline is revealed. It’s really difficult to get interviews with government or oil company officials. I’ve tried off and on for months, to no avail. So for some information I watch what comes through the (state-run) press. Nothing is straightforward. Items often appear about events that occurred months earlier, for seemingly no reason, but sometimes interesting little nuggets of information are mentioned in passing.

If you’re not paying attention, they are easily overlooked. For example, a few days ago, the Cameroon Tribune (government publication) ran an article about the pipeline with the headline, “36.75 million barrels of oil and 7.6 billion Francs” (That’s about US$ 17 million.)

The article, basically highlights from the October 2010 Pipeline Steering and Monitoring Committee report, began with details on the quantity of oil that had transited across Cameroon during the first ten months of 2010, along with information on the transit fees. Apparently less oil was pumped in 2010 than in 2009. Okay. Chances are if you weren’t following the pipeline story you wouldn’t even read beyond the headline.

Yet, several paragraphs down, the article contained some intriguing information.

Thinking about offshore drilling

This morning I read Investigation into BP Spill Reveals Incompetence, Greed, Complacency and Cynicism — It’s Time for a New Energy Policy, by Michael Brune, Executive Director of the Sierra Club. The brief article discusses, Deep Water: The Gulf Oil Disaster and the Future of Offshore Drilling, the final report from the Obama-appointed investigative commission. Although the report and its recommendations concern the U.S., it is easy to see the significance for Africa, where oil offshore drilling is on the rise.

This morning I read Investigation into BP Spill Reveals Incompetence, Greed, Complacency and Cynicism — It’s Time for a New Energy Policy, by Michael Brune, Executive Director of the Sierra Club. The brief article discusses, Deep Water: The Gulf Oil Disaster and the Future of Offshore Drilling, the final report from the Obama-appointed investigative commission. Although the report and its recommendations concern the U.S., it is easy to see the significance for Africa, where oil offshore drilling is on the rise.

I’ve recently posted information about the Scottish company, Bowleven, and its new oil finds off the coast of Cameroon. This is no small story: exploration over the past few months indicates that these discoveries are even more promising than initially thought. And Cameroon is not alone. There are new finds in Nigeria. Ghana is now pumping offshore oil. From Sierra Leone to Angola, the entire Gulf of Guinea region is poised for major, new offshore development. Africa, and in particular the Gulf of Guinea, is one of the new oil “hot spots” attracting both the major oil companies (American, European, Chinese and Brazilian) and the “minnows” or “wildcats,” the smaller, independent companies who used to “explore-discover-sell,” but are now getting in on the drilling action, too. Spend a few minutes reading the trade papers and you’ll quickly get a sense that this is the new Wild West.

There’s money, and lots of it, to be made offshore. I remember reading once that the oil business in Equatorial Guinea worked well for the Americans. With all the activity offshore, work crews could be helicoptered in every few weeks. No need to get too close to the abysmal situation on the ground in the country. Oil money fuels the corruption, repression, income inequality and political instability in the country, but the offshore drilling continues without a hitch.

So far, at least. What we hear little about are the environmental risks and dangerous lack of regulation, oversight and response capability that are unfortunately the norm for much of the offshore drilling in the Gulf of Guinea. As I mentioned in a post several weeks ago, I’m looking into the oil spill response plans of Cameroon and other countries in the region. I have yet to see anything reassuring.

More to follow.

Producing oil only to import gas

Crazy, isn’t it. Cameroon produces oil and, of course, transits Chad’s oil across its territory, but imports all of its gasoline and kerosene. And in 2010 the government subsidized imported fuel to the tune of $276 million.

That’s one part of the “resource curse” that gets less coverage, but fits completely into to the post-colonial (or neo-colonial, if you like) model of African countries that export raw materials only to import those same materials as finished goods. Gasoline isn’t exactly a “manufactured” good, but why should Cameroon import all its gasoline (much of it smuggled in, by the way, from the Nigerian oil-bunkering trade)? Wouldn’t it make sense to invest in refining capacity? And why does Cameroon subsidize fuel?

2011: Oil will lead economic growth in Africa

For better or for worse…

It’s January 1st and it seems fitting to post this piece from the “beyond brics” blog at the Financial Times.

What slowdown? Oil to drive growth

December 17, 2010 10:42 am by Henry Mance

For the global economy, Christmas parties came early this year: stimulus spending boosted growth to possibly unsustainable rates. Next year, a mild hangover is likely to kick in – with slower growth in much of the world, including China, India and Brazil.

Yet, for those in need of some more festive cheer, there are three regions that are forecast to see faster growth in 2011: the Middle East and North Africa, sub-Saharan Africa, and Russia and central Asia. All three will average at least 4.6 per cent growth, according to the IMF, overtaking Latin America as the world’s most dynamic regions after Developing Asia. Why are they accelerating? The common thread is oil.

A few end-of-the-year thoughts

Another year comes to an end, and along the Chad-Cameroon oil pipeline not much has changed. Well there are new mosquito nets, but besides that you will be hard-pressed to find any positive developments for local populations.

The government of Chad continues to collect oil revenues, but apparently is unable to use them to benefit Chadians. Of course the time for believing that the country’s oil wealth would be put to good use is long gone, but it would still be nice to be surprised. With both parliamentary and presidential elections scheduled in 2011, perhaps Deby will decide to put some of the country’s oil money (approximately US$ 5.7 billion earned from project start to July 2010) towards development.

More likely, however, Chad’s oil money will continue financing arms and the military. Deby increased military spending by an astonishing 663 percent between 2000 and 2009, made possible, of course, by oil. And with new Exxon drilling, as well as the Chinese oil projects in the country, there will be plenty of oil money for the foreseeable future.

In Cameroon no one expected the pipeline to bring much wealth to the country (pipeline earnings account for somewhere between 2 and 4% of the Cameroonian budget), and it is unlikely that anyone was waiting for oil money to be spent responsibly. But people hoped, and were assured by the project partners, that the pipeline would not make things worse. Unfortunately, for too many people living along the pipeline, life is harder today than it was before oil arrived.

But there is some encouraging news: the U.S. legislation passed this summer requiring S.E.C. registered extractive industries companies to disclose all payments to governments is an important step towards increased transparency. Transparency is not an end in itself, but is part of an equation that will hold governments accountable and increase the chances that resource revenues are spent wisely. As I said, Chad has elections in 2011 and so does Cameroon (a presidential election in October). Neither Chad nor Cameroon are known for being democratic and there’s no reason to be overly optimistic. However, it’s an interesting moment in the history of “françafrique” and the ongoing electoral crisis in Ivory Coast may very well have implications throughout the region.

Pipeline: Cameroon earns 277.6 million U.S. dollars in seven years

I came across an interesting article that appeared in the Cameroonian daily, Mutations, on December 28th. At a ceremony launching a COTCO-sponsored mosquito net distribution campaign, Guillame Kwelle, the COTCO public and governmental affairs manager, announced that Cameroon had earned nearly US$ 278 million from the pipeline.

Really?

There has been little financial information made available by the Cameroonian government since the pipeline became operational and critics of the project have often pointed to the total lack of transparency regarding Cameroon’s earnings. How much money does the pipeline actually bring in and where does it go? The earnings from the pipeline are part of Cameroon’s petroleum revenues, but there is no data available that would allow people to see what percentage of those revenues comes from the pipeline — as opposed to other oil operations — nor is there any way to know how those revenues are spent. Even if the transit fees are fairly easy to calculate (a fixed, per barrel fee), all the other assorted taxes and fees are harder to estimate. So, this announcement at a COTCO public relations event is newsworthy.

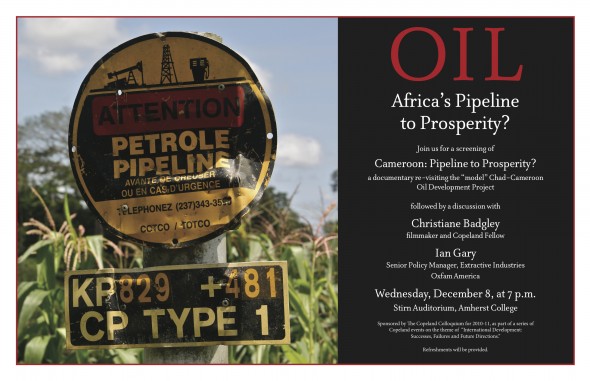

OIL: Africa’s pipeline to prosperity?

Ian Gary, Senior Policy Manager for Extractive Industries at Oxfam America, joined me at Amherst College on December 8th for a screening and discussion on Africa’s oil challenges. Gary, who co-authored, Chad’s Oil: Miracle or Mirage? in 2005, reminded us that Africa’s oil boom will provide more that $400 billion to African governments through 2019. By 2015 the U.S. will get 25% of its imported oil from Africa.

Chad’s oil, to the surprise of no-one really, has hardly worked miracles. The country is no better off than it was before oil production began. Most economic indicators are down. The people in the oil-producing region are much worse off than they were before the oil boom. Farmers for the most part, many in the Doba Basin area are no longer able to access their lands, now dotted with drill pads and crossed by pipes and high tension cables. In 2010, the World Bank admitted that “in reality, close to 50 percent of expenditures has gone to the military.”

Chad, once the “model” for oil development (although one can argue that Chad was only a “model” until oil began to flow), has now joined the ranks of examples to avoid. The resource curse strikes again. Ghana is next, with its first oil shipping on December 15th. Will Ghana go the way of Chad or will the country get it right this time? Although the Ghanaian government has made pledges and promises, recent news suggests that there is some cause for concern (read a few of the latest articles posted on Ghana Oil Watch to get a sense of the troubles on the horizon).

How Dick Cheney Ruined My International Anti-Corruption Day

Read this blog post by Ann Hollingshead from the Task Force on Financial Integrity and Economic Development. A reminder that when setting out to fight corruption and fraud, it’s a good idea to be beyond reproach.

Today is International Anti-Corruption Day, established by the United Nations, as a day of awareness for the issue. As the UN describes it: “Attitudes on corruption are changing. As recently as ten years ago, corruption was only whispered about. Today there are signs of growing intolerance toward corruption and more and more politicians and chief executives are being tried and convicted.”The United States has proven itself the world’s trailblazer …

via How Dick Cheney Ruined My International Anti-Corruption Day.

WikiLeaks cables: Shell’s grip on Nigerian state revealed

I am posting an article from The Guardian. This news is a stark reminder that the “resource curse,” is not just a problem of bad governance and corrupt politicians.

The oil giant Shell claimed it had inserted staff into all the main ministries of the Nigerian government, giving it access to politicians’ every move in the oil-rich Niger Delta, according to a leaked US diplomatic cable.

The company’s top executive in Nigeria told US diplomats that Shell had seconded employees to every relevant department and so knew “everything that was being done in those ministries”. She boasted that the Nigerian government had “forgotten” about the extent of Shell’s infiltration and was unaware of how much the company knew about its deliberations.

The cache of secret dispatches from Washington’s embassies in Africa also revealed that the Anglo-Dutch oil firm swapped intelligence with the US, in one case providing US diplomats with the names of Nigerian politicians it suspected of supporting militant activity, and requesting information from the US on whether the militants had acquired anti-aircraft missiles….

Campaigners tonight said the revelation about Shell in Nigeria demonstrated the tangled links between the oil firm and politicians in the country where, despite billions of dollars in oil revenue, 70% of people live below the poverty line.

Deja vu all over again

In a few weeks Ghana’s first oil will ship and lately the news coming from Accra has been less than encouraging. There’s been a lot of talk the past few years about making oil revenues work for the Ghanaian people (with references to avoiding Chad’s problems), but now that the country is moving from talk to action there’s cause for concern.

CHAD: Flood victims contend with thugs, cholera and hippos

Below is an article from IRIN (UN). The flooding in Chad and elsewhere in the region has been getting far too little coverage in the Western media. Many areas in Chad and beyond are experiencing a level of rainfall and flooding that hasn’t been seen for 50 years. Chad has suffered through several years of drought and although the rains may provide relief in some places, flooding is wreaking havoc in many parts of the country. Villages and farms have been destroyed; flooded fields are particularly worrisome in Chad where hunger is already a problem.

The tragic irony: All the oil money in the world can’t prevent torrential rain and flooding, and given the likelihood that the floods are related to global climate change, oil may be in part to blame for the situation. The question now, however, is whether the government of Chad has — or will — use its oil revenues to improve the country’s infrastructure. Improved sanitation, roads and the construction of canals and dykes are critical moving forward.

WALIA, 17 November 2010 (IRIN) – Scores of families recently displaced by flooding in the Chadian capital N’djamena face a daily struggle against local thugs, wild animals, a lack of toilets and night winds that knock down makeshift tents.

The Chad government announced in late October that it would relocate thousands of people hit by flooding when the River Chari burst its banks, but any such move will take time; in the meantime families whose homes crumbled are just getting by – new hardships adding to what were already tough living conditions in their neighbourhood of Walia.

“We are exposed to too many dangers here,” said Obed Langkal, seated with other residents of the tents and makeshift shelters set up on a stretch of land between a main road and the river. “We cannot rest comfortably at all.”

The recurring question

Oil, an opportunity for economic development or a curse for African countries? That question is the subject of a recent radio panel on RFI (Radio France Internationale). It’s a two-part feature, in French. One of the invited guests, Gerard Magrin, is a Chad specialist who has written about southern Chad’s transition from cotton fields to oil fields.

Oil, an opportunity for economic development or a curse for African countries? That question is the subject of a recent radio panel on RFI (Radio France Internationale). It’s a two-part feature, in French. One of the invited guests, Gerard Magrin, is a Chad specialist who has written about southern Chad’s transition from cotton fields to oil fields.

You can listen to the discussion here:

Here’s a link to the second half of the discussion:

http://www.rfi.fr/emission/20101114-2-debat-le-petrole-opportunites-developpement-malediction-pays-africains

Speaking of farming, the subsistence farmers of Chad would have certainly benefited from an end to U.S. subsidies for American cotton farmers. Instead they got oil. That’s “development”. You can read more about how U.S. subsidies hurt African cotton growers in a recent Guardian article, “The Great Cotton Stitch-Up”.

Definitions of corruption

Defining corruption is not as simple as one might think. The Asian Development Bank (ADB) website provides some interesting information on the definitions of corruption: “As a shorthand definition, ADB defines corruption as ‘the abuse of public or private office for personal gain.’ A more comprehensive definition is as follows: ‘Corruption involves behavior on the part of officials in the public and private sectors, in which they improperly and unlawfully enrich themselves and/or those close to them, or induce others to do so, by misusing the position in which they are placed.'”

I recently posted an article about anti-corruption efforts at the World Bank. I found the article interesting and the efforts of the Bank worth noting. However the fight against corruption has to go a lot further than crackdowns on bribery to be effective. If the Bank really wants to fight corruption, it has to work towards a cultural shift, supporting capacity-building measures that can help countries move away from a culture of impunity and towards the rule of law.

Worse, at times it appears that the Bank plays a double role: crackdowns on bribery and fraud on one hand, enabling projects that reinforce the status quo on the other.

I’m back…

The marine loading terminal (FSO), photo by Christiane Badgley

It has been quite awhile, but I’m back to work on Pipe(line) Dreams. I’ll post new video soon along with some updates and oil news.

Gas Is Really Costing Us About $15 a Gallon

"Oil Tear," by George Osodi

Gas Is Really Costing Us About $15 a Gallon | | AlterNet.

Read this and think.

This excellent article details many of the “externalized” costs of oil production — costs that we pay through the myriad subsidies we provide to the oil companies. And one thing worth noting with this accounting: the costs of damage caused by drilling and spills in many developing countries can only be guesstimated. Standard operating procedure for oil companies working in locales far from prying journalists or vigilant authorities is to simply ignore environmental and economic damage.

Out of sight, out of mind.

Oil…A Pipeline to Prosperity?

Tourists at Bume Beach, opposite the pipeline's marine loading terminal. Photo by Christiane Badgley

I have produced a short film for PBS/Frontline World to mark the 10th anniversary of World Bank engagement in the Chad-Cameroon Oil Development and Pipeline Project. Cameroon: Pipeline to Prosperity? revisits the story of the “model” oil for development project. Ten years ago the oil companies and the World Bank promised that this project would break the resource curse and prove to the world that oil could be a force for good…

What has happened? Watch the film to see how Chad’s oil has impacted life along the pipeline in Cameroon.

This work was produced with support from Frontline World, The Pulitzer Center on Crisis Reporting and The Center for Investigative Reporting.

Cameroon: Pipeline to Prosperity? is the first installment in my ongoing exploration of Africa’s booming oil industry, Pipe(line) Dreams. You can read more about the project on the website.

Please support my work on this project by viewing the film and leaving your feedback. It is crucial to show funders that this work matters!

The U.S. now imports more oil from Africa than from the Middle East, with oil accounting for more than 80% of all African imports into the country. African is soon expected to account for close to one quarter of U.S. oil consumption.

With Africa increasingly seen as the next frontier of oil exploration, there is no shortage of oil companies lining up for financing from the World Bank Group. Oil drilling has begun in Ghana with support from the World Bank Group; loans may soon be approved for Uganda. New oil has been found in Chad, Cameroon, Nigeria, Angola — even Sierra Leone. The list goes on, with government and corporate officials in each country promising to make oil work for the people.

But in countries lacking accountability, with weak legal systems and lax or nonexistent environmental regulation and enforcement, is oil really a viable development option? And is there a valid reason that public funds subsidize these projects? Both the U.S. and China depend heavily on African oil, yet we rarely see anything about how that oil dramatically transforms African communities, economies and environments. Pipe(line) Dreams, a timely and globally relevant story, will bring much needed attention to the rapidly expanding oil industry in Africa.

Nigeria’s agony dwarfs the Gulf oil spill. The US and Europe ignore it.

The Deepwater Horizon disaster caused headlines around the world, yet the people who live in the Niger delta have had to live with environmental catastrophes for decades.

John Vidal, environment editor, The Observer, Sunday 30 May 2010

We reached the edge of the oil spill near the Nigerian village of Otuegwe after a long hike through cassava plantations. Ahead of us lay swamp. We waded into the warm tropical water and began swimming, cameras and notebooks held above our heads. We could smell the oil long before we saw it – the stench of garage forecourts and rotting vegetation hanging thickly in the air.

The farther we travelled, the more nauseous it became. Soon we were swimming in pools of light Nigerian crude, the best-quality oil in the world. One of the many hundreds of 40-year-old pipelines that crisscross the Niger delta had corroded and spewed oil for several months.

Forest and farmland were now covered in a sheen of greasy oil. Drinking wells were polluted and people were distraught. No one knew how much oil had leaked. “We lost our nets, huts and fishing pots,” said Chief Promise, village leader of Otuegwe and our guide. “This is where we fished and farmed. We have lost our forest. We told Shell of the spill within days, but they did nothing for six months.”

That was the Niger delta a few years ago, where, according to Nigerian academics, writers and environment groups, oil companies have acted with such impunity and recklessness that much of the region has been devastated by leaks.

In fact, more oil is spilled from the delta’s network of terminals, pipes, pumping stations and oil platforms every year than has been lost in the Gulf of Mexico, the site of a major ecological catastrophe caused by oil that has poured from a leak triggered by the explosion that wrecked BP‘s Deepwater Horizon rig last month.