Scientists forced to turn over emails related to BP oil spill

The Guardian reports today that two scientists “have accused BP of an attack on academic freedom after the oil company successfully subpoenaed thousands of confidential emails related to research on the Gulf of Mexico oil disaster.”

The accusation comes from oceanographers Richard Camilli and Christopher Reddy of the Woods Hole Oceanographic Institution in Massachusetts.

China, Nigeria and oil

Oil’s curse sends millions abroad in search of opportunity.

I’m back from China where I spent a few weeks working with the Nigerian community of Guangzhou on a project that has nothing to do with oil. That said, oil came up in virtually every conversation I had with Nigerians: The oil money that has corrupted the country, killing off business enterprise and agriculture. The oil pollution that has ravaged the Niger Delta for decades, ruining countless lives and the environment.

Many people asked me when I would go to Nigeria to report on that country’s oil curse. Over and over again, people asked me why the BP Deepwater Horizon disaster was covered by the media and — most importantly — cleaned up, while the Niger Delta disaster is left untouched and rarely gets mentioned in the international press.

Thoughts on ExxonMobil from China

I’m writing from Guangzhou, China, where I’m spending a few days working with the city’s Nigerian community. This work is not directly related to oil, although it’s not hard to make the connection. The corrosive impact of oil on the Nigerian economy (and society more generally) comes up again and again in conversations.

How many Nigerians have left their country because of its oil-generated “wealth”?

ExxonMobil’s dark empire

Steve Coll’s new book, Private Empire: ExxonMobil and American Power, is out and Democracy Now! has an extensive interview with him about Exxon’s dirty dealings from Indonesia to Nigeria and Chad.

Here’s an excerpt from the interview about ExxonMobil’s involvement in Chad:

Chad, of course, is a benighted country—today about 181st out of 187 countries in the human development index kept by the United Nations indicating quality of life. Life expectancy there is still below 50 years. But it has oil. And its authoritarian leader, to put it politely, Idriss Déby, decided to try to develop this oil, even though Chad was landlocked and didn’t have any national capacity to build an oil company, so they invited in Exxon and the World Bank. And they undertook this experiment, really without precedent, to require Chad to use its oil profits for the good of its people, spending on education, health and social development. And Exxon was a participant in this and described it as potentially a new model to address the resource curse in Africa, where countries that are rich in minerals but try to develop through the sale of those minerals often fail to serve their people very well. So this was a kind of a grand experiment. And it failed.

New pipeline safety report: Much room for improvement

Vulnerable to dangerous spills: The Chad-Cameroon pipeline crosses a number of rivers in remote, densely forested areas. Photo: Christiane Badgley

The New York Times Green Blog reports on a new pipeline study from the U.S. National Wildlife Federation (NWF).

Times reporter Dan Frosch writes that the NWF study, “asserts that federal laws regulating oil pipelines are inadequate in several crucial areas and that local regulations do not provide sufficient protection against safety and environmental risks.”

The NWF report was prompted by a July 2010 rupture of an Enbridge Energy Partners oil pipeline in Michigan that spilled some 1 million gallons of crude oil, contaminating more than 30 miles of a major Lake Michigan truibutary. According to NWF, the incident, “raised health concerns and killed wildlife. It also exposed numerous weaknesses in pipeline regulation.

Ghana: gas, cash and jobs

IS LOCAL CONTENT A PIPEDREAM? from Channel Two Communications on Vimeo.

There’s been a flurry of excited news coming out of Ghana the past few weeks. Ghana’s growth rate hits 16%. Ghana signs the first $1 billion of its $3 billion loan agreement with China. An additional $6 billion Chinese loan is in the works. The $1.2 billion gas plant project will soon move into high gear. Vice President John Dramani Mahama says Ghana will rake in $1 billion from gas annually and that will allow Ghana to pay off the $3 billion loan ahead of schedule. He predicts the gas industry will create hundreds of thousands of jobs. (Check out Ghana Oil Watch for articles on all this and more.)

Wow! All sounds amazing, but is it too good to be true?

An Al Jazeera must watch

If you are concerned in the least about the environmental risks of drilling, don’t miss Al Jazeera’s latest feature report from the Gulf of Mexico, “Gulf seafood deformities alarm scientists.”

This reporting is so scary — it paints a picture of devastation that flies in the face of the feel good, everything is fine, BP-sponsored “My Gulf” ad campaign. Mutant shrimp and crabs. Dead dolphins. Strange lesions and tumors on fish. Missing eyes and oil-soaked gills. Dramatic declines in catch levels since the Deepwater Horizon disaster. It’s a nightmare and it appears that this is only just beginning.

Chad: Oil money, hungry people

Today Chad is facing a food crisis. An alarming number of people are hungry and sick in the northern part of the country.

The Guardian ran a story recently on the dire situation, Chad’s malnourished children offer stark illustration of Sahel food crisis.

Strangely, the article doesn’t mention the fact that Chad is an oil producing nation with sizeable oil revenues.

Chad earned more than US$2 billion in 2011 from the ExxonMobil Doba fields project. As I’ve reported, by 2008 Chad had already earned more than US$8 billion from the Chad-Cameroon oil development project. China is also drilling and refining oil in Chad. I don’t have figures for Chad’s earnings from Chinese drilling, and the Chinese-built and 60% owned refinery has been mired in conflict since it opened in June 2011. But the point remains: Chad has oil revenues, but apparently there’s not enough money to deal with the food crisis.

Lloyd’s of London to Arctic would-be drillers: Slow down

The Guardian is reporting that Lloyd’s of London, the world’s largest insurance market, has voiced concern about proposed offshore Arctic drilling. The company says clean-up of any spill would present, “multiple obstacles, which together constitute a unique and hard-to-manage risk.”

Reading the article, several paragraphs jumped out because they could also be useful for policy makers in Africa, many of whom are jumping on the drilling bandwagon without having adequate safety and emergency response systems in place:

Richard Ward, Lloyd’s chief executive, urged companies not to “rush in [but instead to] step back and think carefully about the consequences of that action” before research was carried out and the right safety measures put in place….

Other than the direct release of pollutants… there are multiple ways in which ecosystems could be disturbed, such as the construction of pipelines and roads, noise pollution from offshore drilling, seismic survey activity or additional maritime traffic….

From one disaster to another

The two year anniversary of the Deepwater Horizon explosion is just a days away, and as Bryan Walsh from Time magazine puts it, the “oil spill seems to divide people into two categories: those who can’t forget, and those who refuse to remember. In the first camp are Gulf Coast residents and environmentalists who say the region still hasn’t recovered from the worst oil spill in U.S. history, and who are still waiting to be made whole—as BP once promised. In the second is much of the oil industry and many Republicans, who like to complain that offshore drilling has slowed under President Obama, yet seem to forget the multi-billion dollar damage that the oil spill left, and the months it took to repair the Macondo blowout.”

You can read more in his article, Nearly two years on, did the BP oil spill have to happen to BP?

And while we’re wondering about the inevitability of BP’s spill, Total’s North Sea gas leak appears to be much worse than originally reported:

Sitting on a powder keg of highly flammable natural gas and gas condensate, the French oil major’s rig could be one of the worst oil disasters in the North Sea. A gas cloud, made mostly of methane, has essentially enveloped the rig after attempts to shut a troubled production failed and caused a leak. If this cloud — which is growing by roughly 200,000 cubic meters a day — ignites, it could be catastrophic.

Clearly, the potential for human and environmental tragedy is the paramount concern here, much as it was with BP’s Gulf of Mexico disaster.

World Bank approves loan for Cameroon’s Lom Pangar dam

Once again the World Bank has signed on to a high-risk project with questionable poverty-reduction potential.

Of course, reading the press release from the World Bank, you would never guess that this project could be anything less than wonderful:

WASHINGTON, March 27, 2012 – The World Bank’s Board of Executive Directors today approved US$132 million in zero-interest financing for Cameroon’s Lom Pangar Hydropower Project (LPHP), to support the country’s economic development and significantly improve the supply of electricity to homes and businesses across Cameroon.

The silent victims of oil pollution

News from the U.S. National Oceanic and Atmospheric Administration (NOAA) is supporting what many have been saying for months: Pollution from the Deepwater Horizon spill is ongoing and harming life in the Gulf of Mexico.

Yesterday the NOAA released information on the disturbing results of its dolphin study, which found that bottlenose dolphins in the Gulf of Mexico are “severely ill.”

The news was reported by the New York Times and elsewhere, but it was buried down in the environment section. The environment, dolphins, pollution — none of this seems as important as rising gas prices and the administration’s efforts to boost drilling both onshore and offshore.

Cameroon quietly ups oil production

Kribi, Cameroon, where sleepy beach resorts will soon give way to a major port and gas plant. Photo by Christiane Badgley

Cameroon’s oil industry doesn’t get much international attention these days, but like its neighbors the country has seen growing offshore activity over the last few years. After years of declining output, the country’s production levels are once again on the rise.

The Scottish company, Bowleven, has been drilling in Cameroon for several years now and its hits and misses usually get some coverage in the business press. Kosmos Energy, Perenco, Shell, ExxonMobil and Noble Energy, among others, are also actively drilling in the country.

Although Cameroon’s oil production levels are close to those of Ghana, there’s no talk of transparent revenue management in Cameroon. The country recently had its EITI candidacy status renewed for another 18 months. It should be noted that the country was already “close to compliant” in 2010 and hasn’t made much progress since. According to EITI rules, “If Cameroon does not achieve Compliant status by 15 August 2013, it will be de-listed.”

Job woes and local content

The dearth of oil jobs in Ghana is back in the news again.

“Youth angry over elusive jobs in oil industry,” was the title of an article published in the Ghanaian press on March 12th.

The article cites Ebow Haizel-Ferguson from Sigma-Base Technical Services, who urges the rapid development of “ancillary industries.” I interviewed Haizel-Ferguson for “Ghana: Will oil mean jobs?” a short video I produced for the Pulitzer Center .

Oil brings in huge amounts of money, of course, and along with that comes expectations of many, well-paid jobs. The problem is that the industry – at least as it exists in Ghana now – doesn’t generate much work.

Chevron says Nigerian rig fire extinguished

After suggesting that the rig fire off the coast of Nigeria could burn “for months,” Chevron has announced that it is no longer burning.

Apparently the fire stopped burning by itself several days ago, as gas was no longer flowing from the well. I have read differing accounts about why the gas stopped leaking, but at this point Chevron can’t guarantee that this is the end of the story. The company is continuing with relief well drilling.

There is still no information available on environmental damage or compensation for fishermen and villagers who say that both their livelihoods and their health have suffered as a result of the 45+ day fire. For more than one month now, there have been news reports of tests to determine contamination levels. But we’ve yet to see any results.

BP: A settlement and many unanswered questions

For those who believed that a trial would be the best way to hold BP accountable for the shortcuts and errors that resulted in the deadly Deepwater Horizon disaster, the news out of New Orleans last night was not good.

BP has reached an agreement and will settle the case brought against it by companies and individuals whose livelihoods were impacted by the Gulf oil spill.

Judge Carl J. Barbier of Federal District Court in New Orleans issued an order late Friday night stating that the two sides “have reached an agreement on the terms of a proposed class settlement which will be submitted to the court,” and announcing that the first phase of the trial, scheduled to begin on Monday, is adjourned indefinitely while the next steps are worked out.

“Good” oil companies, “bad” oil companies

Tullow Oil has recently completed a controversial $2.9 billion sale of parts of its Ugandan oil stakes. Tullow’s deal with Total (France) and CNOOC (China), which had been mired in disputes with the Ugandan government for more than a year, was finalized despite a parliamentary resolution to suspend all oil contracts until laws and institutions are in place to fight corruption.

Uganda’s oil reserves appear to be significant, and there are indications that the region could be another oil bonanza. But at the moment, fears of corruption are dampening the mood. According to a recent article from the Associated Press Uganda stands to earn some $2 billion per year for the next 35 years, but:

“All signs are that Uganda will be the latest nation to fall victim to the ‘oil curse’ — cheated of its financial benefits by a corrupt government and left with extensive environmental damage,” said Uganda’s Association of Professional Environmentalists.

Critics are already complaining that more than $300,000 paid in signature bonuses on oil contracts already have gone missing. Legislators have accused the prime minister and two Cabinet ministers of taking millions of dollars in bribes from Tullow — charges Tullow denies.

The controversy surrounding Tullow’s operations in Uganda doesn’t fit with the image of Tullow Oil in Ghana.

Chevron’s Endeavour rig: the story changes, but the fire still burns

Al Jazeera report February 4, 2012

First there’s news of a rig fire, which turns out to be much more than just a fire. In fact, it’s an exploratory gas well burning uncontrollably. That’s called a blowout and it’s what happened to the Macondo well in the Gulf of Mexico. The well spews oil or gas until it can be “killed.”

Chevron, the owner of the Endeavour rig, does not use the term blowout. But the company did admit that drilling a relief well would be necessary to cut off the flow of gas. A few days ago, company officials announced that drilling of the relief well had started.

Now, we have an update from the BBC. Speaking to a BBC reporter, Chevron spokesman Lloyd Avram has acknowledged that, “A gas-fuelled fire, with flames as high as 5 meters, may burn for months in waters off the Niger Delta in south-east Nigeria.”

Key political risks in the Gulf of Guinea

Reuters has issued its annual report on “political risks” in the Gulf of Guinea. The report has little to do with how things are going for the people who live in the region — the focus is on political uncertainty that may impact investment. Nonetheless, it’s a useful rundown of the main industries and sources of instability across the region.

Piracy has been mentioned in this report for at least three years, but it’s moving higher up on the risk list. This year, the U.S. military presence also appears on the list. Although it is cited as a response to the lack of offshore security, an increased military presence could easily exacerbate instability in the region.

Nigeria: Chevron starts drilling offshore relief well

For more than one month, the Chevron Funiwa 1A gas well has been burning uncontrollably off the coast of Nigeria.

I posted some information about this rig fire, caused by an apparent well blowout on January 16th. The fire claimed the lives of two rig workers. On January 26th, Chevron announced that the company was, “finalizing plans to commence drilling two relief wells.”

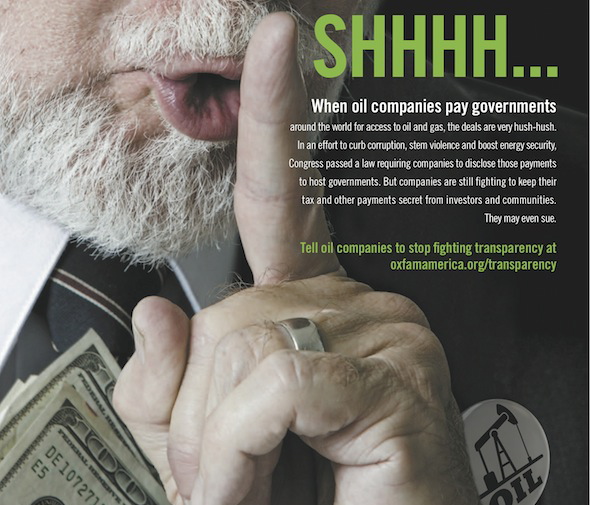

Gloves are off!

There’s something deeply troubling about the notion that, with sufficient money for lawyers and lobbyists, corporations can pressure government officials to undo legislation. The bi-partisan Dodd-Frank financial reform laws were drafted, debated and approved in 2010. As I’ve written in a few recent posts, Section 1504 of this legislation requires oil and gas companies to disclose the amount of money they pay to governments in the countries where they operate (including the U.S.). The idea behind this law is simple: transparency can help those who are working for accountability.

Will Ghana’s Marine Pollution Bill become law this year?

I’m happy to see that Ghana’s Marine Pollution Bill is finally on the way to becoming law. I am speaking a bit optimistically here — the bill just received its first reading in Parliament a few days ago — but why not? As I’ve written at iwatch news, the pressure has been on the government to get pollution legislation passed since November’s “mystery” oil spill. Mystery in quotation marks because there is still no official word on what actually happened.

Newt Gingrich and Big Oil: A match made in heaven

I managed to sit through several speeches from the Conservative Political Action Conference. With each speaker aiming to demonstrate that he was more conservative (read extremist) than his predecessor, it was a painful spectacle. “Throwing red meat to the base,” as the pundits say. And at every toss the hungry crowd erupted in raucous applause and cheering.

I don’t usually write about U.S. politics, but I’m making an exception for the completely over-the-top speech by Newt Gingrich. (Don’t you love how this ethically impaired candidate has become a sort of Tea Party darling?) He didn’t talk about his moon colony, but many of his proposals were just as outrageous.

The transparent hypocrisy of big oil

S.E.C. in bed with the oil companies? Oxfam event in front of S.E.C., February 10, 2012. Photo: Oxfam America

Ian Gary at Oxfam America has posted another excellent piece on the shameless hypocrisy of oil companies now pressuring the S.E.C. to water down parts of the 2010 Dodd-Frank financial reform legislation. (Read my blog post from yesterday for more background on this story.) Here’s the article cross-posted from Politics of Poverty:

The yawning gap between the transparency rhetoric of companies and the reality of their actions has never been more apparent than it is now.

The oil and gas industry loves to trumpet their support of international transparency initiatives and their tax contributions to the US government, but when a new law requires them to tell the public exactly how much gets paid to whom around the world, they bring out the lobbyists and lawyers.

Browse through the corporate social responsibility reports of the top oil and gas companies, and you’ll see them singing from the same transparency hymnbook. Chevron says it “believes that the disclosure of revenues received by governments and payments made by extractive industries to governments could lead to improved governance in resource-rich countries.”